Does Dental Insurance Cover Oral Surgery?

Dental insurance and oral surgery often create confusion, especially when a procedure feels urgent or medically necessary but is still classified as dental care. Many patients assume that if surgery involves anesthesia, incisions, or recovery time, insurance coverage is automatic. In reality, coverage depends on how the procedure is categorized and why it is required.

If you have been told you need oral surgery, understanding how dental insurance works can help you avoid unexpected expenses and move forward with treatment confidently. This article explains when dental insurance covers oral surgery, when medical insurance may apply, and what factors influence coverage decisions.

How Dental Insurance Classifies Oral Surgery

Dental insurance is primarily designed to support preventive and restorative care. Oral surgery sits in a more complex category because it may address dental disease, medical conditions, or both.

Insurance providers focus on intent rather than complexity. A procedure performed to control infection or prevent further damage is evaluated differently than one performed to replace missing teeth. This distinction is one of the main reasons coverage varies so widely between patients.

Because oral and maxillofacial surgeons work beyond routine dental treatment, insurers often distinguish these procedures from care provided in traditional dental offices. This difference becomes clearer when comparing oral surgery to general dentistry in terms of scope and clinical responsibility.

Oral Surgery Procedures Commonly Covered by Dental Insurance

Dental insurance may partially or fully cover oral surgery when the procedure is necessary to maintain oral health or prevent complications.

Tooth Extractions

Surgical tooth extractions are among the most frequently covered oral surgery procedures. When a tooth is severely decayed, fractured, or infected, dental insurance typically contributes toward removal.

Coverage is more likely when delaying extraction could lead to worsening infection or bone loss. These procedures are usually categorized as major services, meaning deductibles and coinsurance apply.

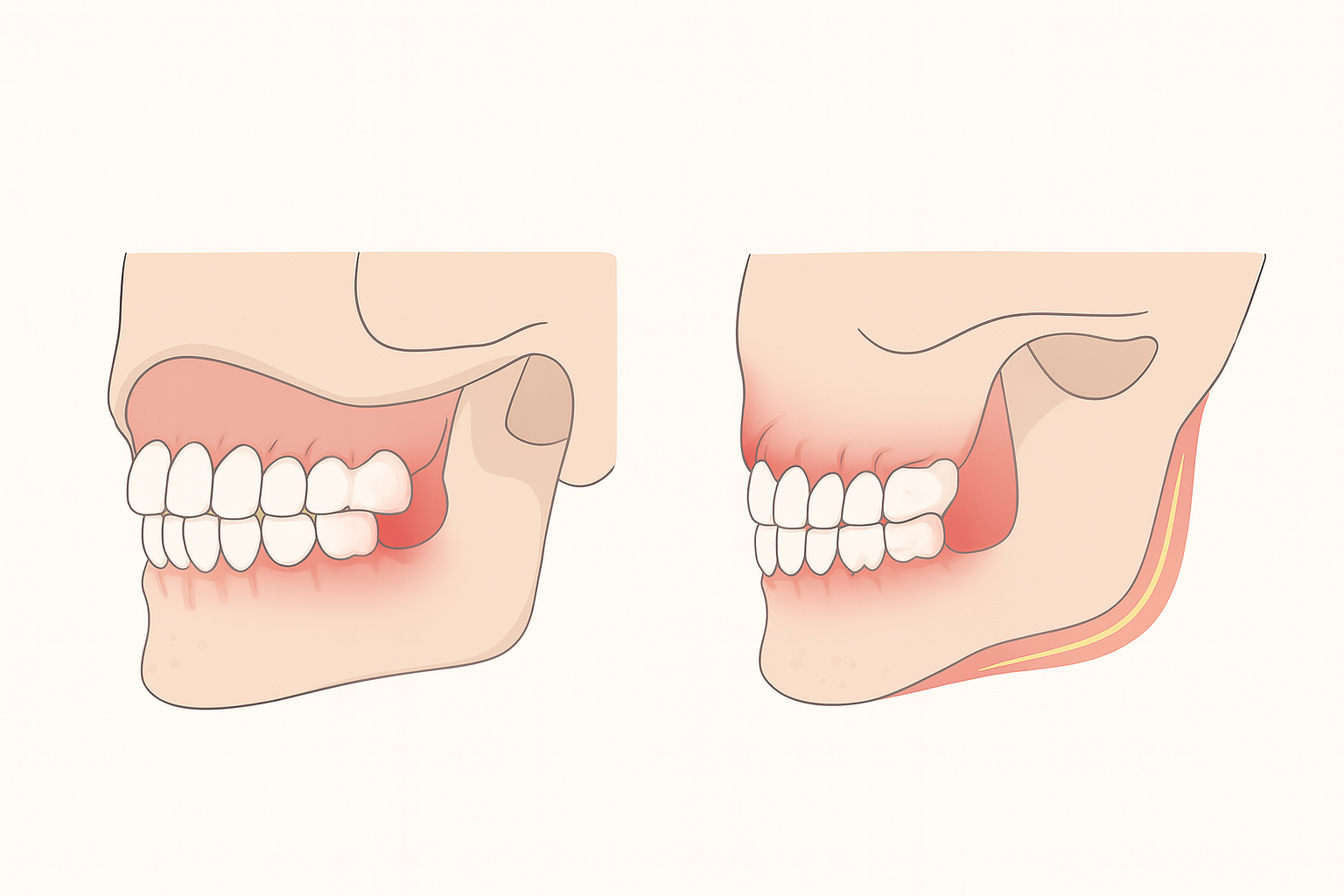

Wisdom Teeth Removal

Wisdom teeth removal is commonly covered, particularly when the teeth are impacted, partially erupted, or causing pain. Insurers recognize that untreated wisdom teeth can lead to infection, crowding, and damage to adjacent teeth.

When wisdom teeth are positioned near the sinus cavity, recovery may follow established sinus surgery protocols, especially when the maxillary sinus is affected during extraction .

Bone Grafting After Extraction

Bone grafting may receive limited coverage when it is performed immediately after extraction to preserve jawbone structure. Dental insurance is more likely to contribute when grafting prevents bone deterioration rather than prepares for implant placement.

Patients should still expect some out-of-pocket costs, as grafting is often only partially covered.

Oral Surgery Procedures Dental Insurance Often Excludes

While dental insurance can help with some surgical procedures, others are frequently excluded.

Dental Implants

Dental implants are often excluded or only partially covered by dental insurance. Although implants restore chewing function and help prevent bone loss, many insurers continue to classify them as elective treatment.

Coverage decisions may vary depending on whether a patient is replacing one tooth or an entire arch, as treatment planning differs significantly between dental implants used for single-tooth replacement and full-arch restoration .

Elective or Cosmetic Procedures

Procedures performed solely for cosmetic reasons, such as elective jaw reshaping or gum contouring, are rarely covered. Insurance providers require documentation showing that surgery improves function or prevents disease progression.

When Medical Insurance May Cover Oral Surgery

Medical insurance may apply when oral surgery is required to treat a medical condition rather than a dental issue. In these cases, coverage is often more comprehensive.

Infection and Emergency Conditions

Severe infections that cause facial swelling, abscesses, or systemic risk may qualify for medical insurance coverage. Facial swelling caused by tooth pain can escalate rapidly and may require urgent intervention when infection spreads beyond the tooth itself.

Situations involving acute inflammation are commonly associated with facial swelling emergencies that require immediate surgical care.

Trauma and Facial Injuries

Oral surgery related to facial trauma, fractures, or injuries sustained in accidents is typically processed through medical insurance. These cases often involve diagnostic imaging, surgical repair, and follow-up care aligned with medical treatment standards.

Why Classification Matters for Insurance Coverage

Insurance companies rely on diagnostic and procedure codes to determine whether a claim falls under dental or medical benefits. The distinction between oral surgery and general dentistry directly affects how claims are processed.

When surgery is performed to restore oral health alone, dental insurance is usually responsible. When the procedure treats infection, trauma, or functional impairment, medical insurance may apply.

Understanding this classification helps patients anticipate coverage outcomes and reduces the likelihood of denied claims.

Insurance Limits That Affect Oral Surgery Costs

Even when oral surgery is covered, policy limitations often determine how much insurance will actually pay.

Annual Maximums

Most dental insurance plans have annual maximums, typically ranging from $1,000 to $2,000. Oral surgery can exceed these limits quickly, leaving patients responsible for remaining costs.

Deductibles and Coinsurance

Patients usually must meet a deductible before coverage applies. After that, insurance may cover 50 to 80 percent of the procedure, depending on the plan.

Waiting Periods

Some policies include waiting periods for major services, including oral surgery. Patients who recently enrolled may need to wait several months before benefits become active.

The Importance of Pre-Authorization

Pre-authorization allows insurance providers to review a procedure before it is performed and determine whether it qualifies for coverage. While not always required, it significantly reduces the risk of claim denial.

During this process, imaging, clinical notes, and justification are submitted to the insurer. This step is especially important for procedures that fall between dental and medical classifications.

Patients who complete pre-authorization typically experience fewer billing surprises and clearer financial expectations.

Managing Out-of-Pocket Costs

Even with insurance, most patients will have some out-of-pocket expenses associated with oral surgery. Understanding these costs in advance allows for better financial planning.

Many practices offer financing or payment plans to help manage expenses. In some cases, combining dental and medical insurance benefits can reduce total costs when procedures meet medical necessity criteria.

Clear communication between the patient, provider, and insurance company helps prevent misunderstandings.

Why Oral Surgery Coverage Varies So Widely

Insurance coverage is not standardized. Employer-sponsored plans, private policies, and individual riders differ significantly in how oral surgery is handled.

A procedure covered under one plan may be denied under another. Reviewing benefits carefully and asking procedure-specific questions before treatment helps patients make informed decisions.

Making Confident Decisions About Oral Surgery

Dental insurance can cover oral surgery, but coverage depends on classification, documentation, and policy limitations. Patients who understand these factors are better prepared to move forward without financial uncertainty.

Oral surgery is often essential for long-term health, comfort, and function. Knowing how insurance applies ensures that necessary care is not delayed due to unanswered questions.

Do Upper and Lower Wisdom Teeth Hurt Differently?

December 11, 2025

Tooth Extraction vs Root Canal: Which Option Works Best for Your Smile?

January 2, 2026

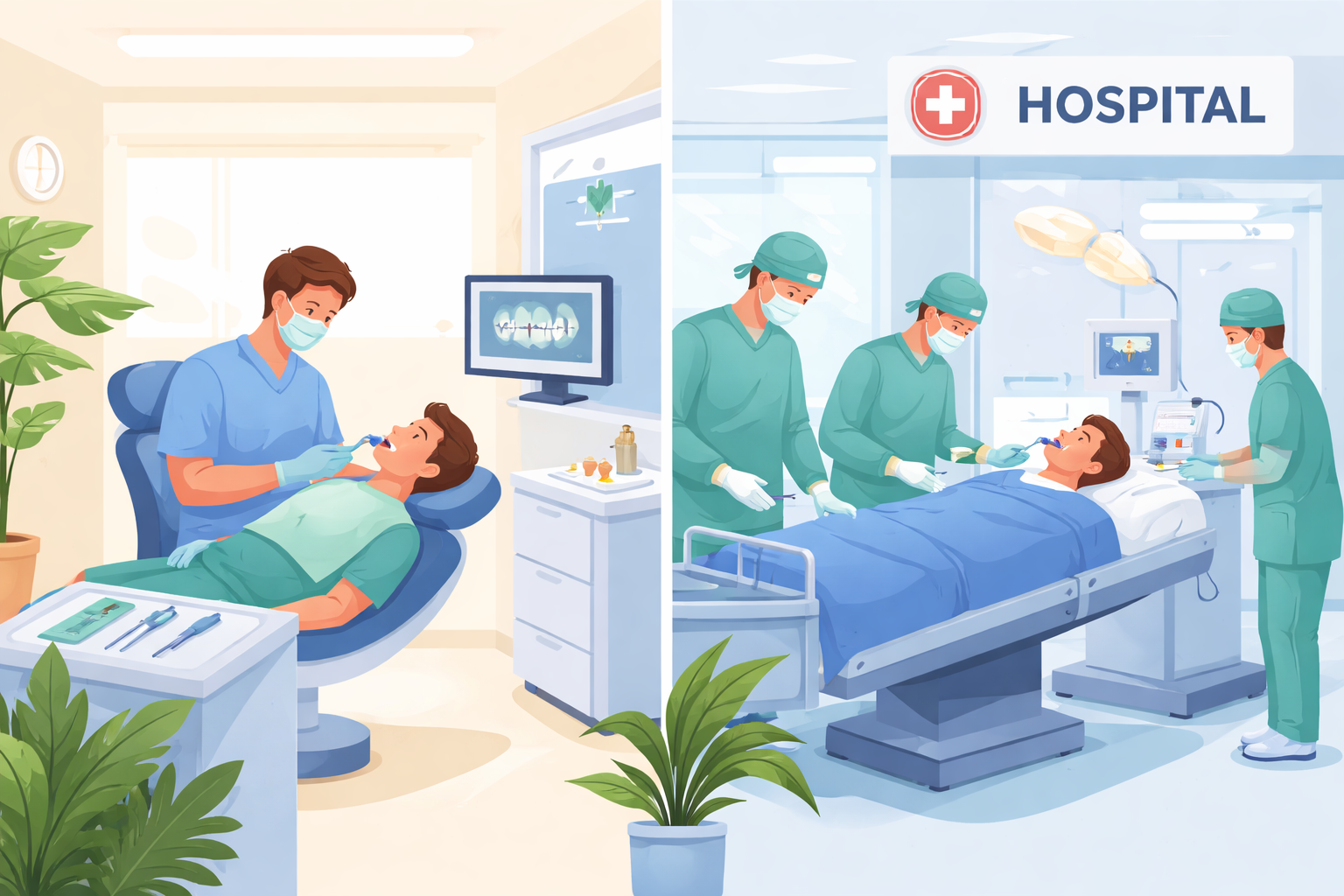

Comparing In-Office vs. Hospital Wisdom Tooth Extraction Costs

January 28, 2026

Laser Oral Surgery: Is It Right for You?

December 29, 2025

Are You a Candidate for IV Sedation During Oral Surgery?

January 12, 2026